UNPARALLELED TRACK RECORD

99 investments and 66 exits completed – over $5.5 billion in value

7 funds raised with outstanding investor loyalty

Over $7 billion in assets under management

Global top ranking as the most consistent performing fund manager

99 investments and 66 exits completed – over $5.5 billion in value

7 funds raised with outstanding investor loyalty

Over $7 billion in assets under management

Global top ranking as the most consistent performing fund manager

OVERVIEW

FIMI is the leading private equity firm in Israel with a track record of success spanning over 25 years. FIMI has raised seven private equity funds with more than $4.3 billion in aggregate capital commitments. Since its inception, FIMI’s performance has been exceptional by both local and global standards.

FIMI is the leading private equity firm in Israel with a track record of success spanning over 25 years. FIMI has raised seven private equity funds with more than $4.3 billion in aggregate capital commitments. Since its inception, FIMI’s performance has been exceptional by both local and global standards.

FIMI uses its knowledge, experience, and resources to source unique investment opportunities, create value for its portfolio companies, and generate maximum returns for FIMI's investors. FIMI leverages a solid, proven, and clear investment strategy, unrivaled access to quality deal-flow, and exceptional in-house expertise to achieve superior results.

OVERVIEW

FIMI is the leading private equity firm in Israel with a track record of success spanning over 25 years. FIMI has raised seven private equity funds with more than $4.3 billion in aggregate capital commitments. Since its inception, FIMI’s performance has been exceptional by both local and global standards.

FIMI uses its knowledge, experience, and resources to source unique investment opportunities, create value for its portfolio companies, and generate maximum returns for FIMI's investors. FIMI leverages a solid, proven, and clear investment strategy, unrivaled access to quality deal-flow, and exceptional in-house expertise to achieve superior results.

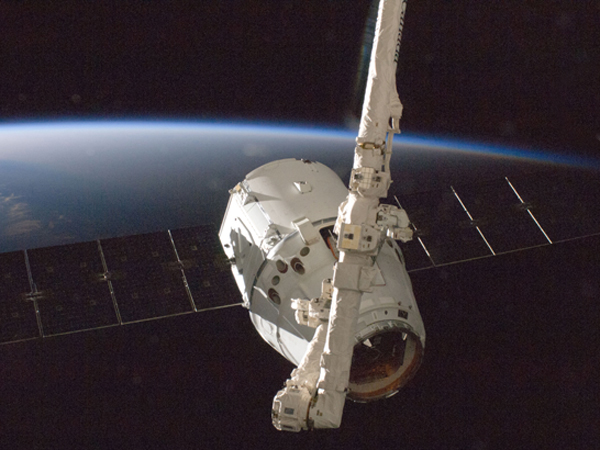

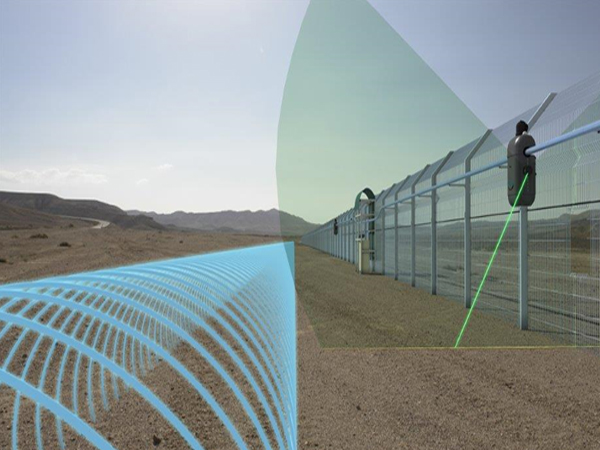

Select Portfolio Companies

Select Portfolio Companies

News Highlights

His Own League - For 25 years, Yishai Davidi has been buying, improving and selling at 3 times

Davidi, chairman and founder of the FIMI, received tens of thousands of votes from surfers and was chosen as No. 2 in the person-of-the-year rankings; "There is no magic here. We work very hard, we have a clear methodology"- a special interview with the investment manager and the good value producer in Israel.

BizPortal, January 7, 2021

FIMI quadruples investment on sale of Rivulis

The Singapore government's Temasek investment fund has completed the purchase of the irrigation systems company for $450 million.

Globes, December 13, 2020

FIMI closes $1.2b seventh fund

The FIMI 7 fund will continue the strategy of the previous funds, which is to invest in and enhance the value of Israeli companies over the long-term.

Globes, December 9, 2020

Global Top Ranking

Preqin, the alternative assets industry’s leading source of data and intelligence, consistently ranks FIMI as one of the top funds worldwide in terms of long-term return for investors.

Global Top Ranking

Preqin, the alternative assets industry’s leading source of data and intelligence, consistently ranks FIMI as one of the top funds worldwide in terms of long-term return for investors.

FIMI Opportunity Funds

Alon Towers 2, 94 Yigal Alon Street

Tel Aviv 6789141 Israel

+972-3-5652244

+972-3-5652245

sec@fimi.co.il

FIMI Opportunity Funds

Alon Towers 2, 94 Yigal Alon Street, Tel Aviv 6789141 Israel

+972-3-5652244 | +972-3-5652245 | sec@fimi.co.il